1. What is Cash Flow and Why It’s Crucial for Businesses

a. What is Cash Flow?

Cash flow is the lifeblood of your business. Yet, running out of cash is the single biggest reason businesses fail – even ones that look profitable on paper. Understanding cash flow isn’t just about knowledge; it’s about your company’s survival. Let’s dive in…

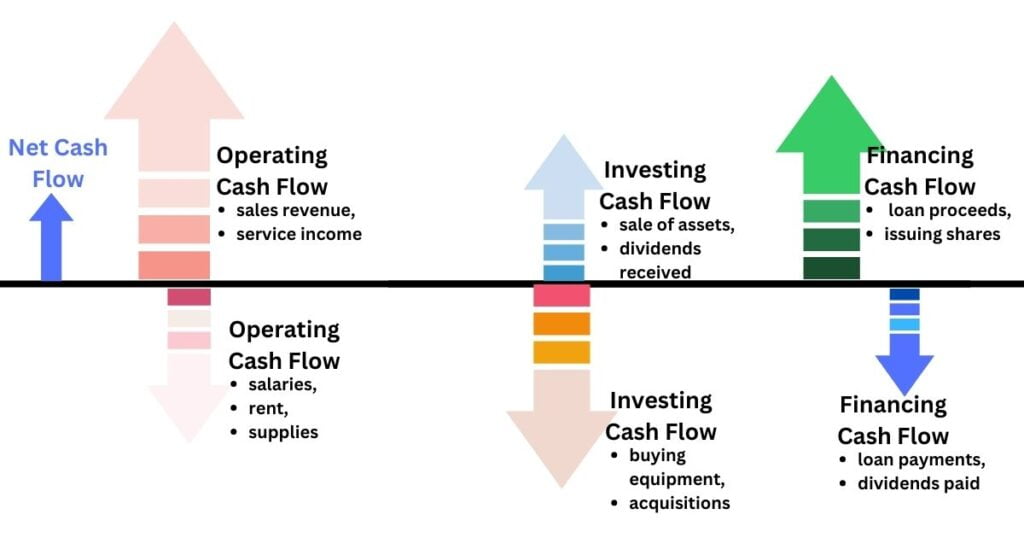

- Operating Cash Flow: generated from core business activities (selling products/services, paying expenses).

- Investing Cash Flow: used for investments (buying equipment, acquiring other businesses).

- Financing Cash Flow: Involves activities like loans or issuing stocks.

Net cash flow is the difference between inflows and outflows over a given period. For a clear definition with visuals, you can check out Xero‘s glossary definition.

Table of contents

b. The Importance of Healthy Cash Flow

Cash flow, unlike profitability, directly impacts a business’s health and longevity

- Operations: Pays for daily essentials like salaries, supplies, and rent.

- Growth: Funds expansion through new assets, marketing, or hiring.

- Obligations: Ensures you meet tax payments, loan repayments, and other financial commitments.

- Opportunities: Gives flexibility to seize new deals, acquisitions, or R&D.

- Survival: Running out of cash is the leading cause of business failure, even for profitable companies.

Example: A company with high sales may still struggle if customers pay slowly. This creates a cash shortage despite profits on paper.

c. Profit vs. Liquidity: What’s the Difference?

Profit is an accounting measure (revenue minus expenses). Cash flow is the actual movement of money. Key differences:

- Timing: Profit may be recorded before customers pay.

- Non-cash items: Depreciation lowers profit but not cash.

- Capital spending: Large asset purchases reduce cash initially, but impact profit over time.

d. How Poor Cash Flow Can Harm Your Business

- Late fees and damaged credit

- Missed growth opportunities

- Potential bankruptcy in severe cases

Key Takeaway: Managing cash flow is essential for business health and longevity. It’s not just about understanding these concepts but actively taking steps to ensure positive cash flow.

2. Navigating Cash Flow Challenges: Strategies for Success

While cash flow is essential for business success, it’s also a common source of problems. Let’s dive into the most frequent challenges and outline proactive solutions to overcome them:

a. Managing Seasonal Income Fluctuations

Sales often vary by season. Solutions: Build cash reserves during peak periods, negotiate off-season discounts with suppliers, explore temporary financing options.

b. Combating Late Customer Payments

Delays in customer payments create cash shortages. Solutions: Set clear payment terms, offer early payment incentives, use invoice factoring services, and maintain proactive collections processes.

c. Controlling Overhead Costs

Fixed expenses like rent and salaries drain cash flow. Solutions: Regularly review overhead costs for potential cuts, negotiate with suppliers, lease instead of buying equipment where possible, consider flexible staffing models.

d. Preparing for Unexpected Expenses

Surprise costs (equipment failure, lawsuits) strain cash reserves. Solutions: Create a contingency fund, invest in insurance where crucial, negotiate extended warranties on major equipment.

e. Is Excess Inventory Draining Your Finances?

Too much inventory ties up cash and slows turnover. Solutions: Improve demand forecasting, use just-in-time inventory methods, offer discounts to clear old stock, liquidate obsolete inventory.

f. Assessing the Risks of Extending Credit

Extending credit without careful checks increases the risk of bad debt. Solutions: Implement rigorous credit checks, offer tiered payment plans for higher-risk customers, use a debt collection agency for persistent non-payment.

g. Funding Growth Strategically

Fast growth strains cash due to new hiring, equipment, and facilities. Solutions: Plan expansion in phases, secure financing in advance, closely monitor cash flow during growth periods, and consider leasing instead of buying.

Key Takeaway: By understanding these challenges and proactively implementing strategies, you can strengthen your cash flow position. This builds a resilient business capable of weathering fluctuations and seizing opportunities for growth.

3. The Big Picture: How to Improve Cash Flow

Understanding the ‘what’ and ‘why’ of cash flow is the first step. Now, let’s explore the major strategies proven to generate healthy cash flow and sustain your business for the long term.

a. Optimize Operating Cash Flow

This focuses on the money flowing from your core business operations – selling your products or services and managing the associated expenses. Key aspects include getting paid quickly, building customer loyalty, keeping costs in check, and exploring ways to increase revenue streams. To learn more about Operating Cash Flow, read article Operating Cash Flow: Your Key to Sustainable Growth

b. Making Smart Investment Decisions

This involves making strategic decisions about money spent on assets, expansion, and other investments that impact your business’s future growth. Think about making cost-effective investment decisions, exploring leasing options, seeking out grants or incentives, and knowing when to “bootstrap”. To learn more making investment, read article Smart Investment Decisions: Building a Strong Foundation for Your Business

c. Strategic Use of Financing

This means obtaining funding from external sources (loans, lines of credit, equity investors) when carefully planned and aligned with your business goals. The focus is on understanding different financing types, building creditworthiness, and using financing responsibly to fuel growth, not just plug temporary gaps. We will post new article soon about finding the right financing solutions for different stages of your business

4. Conclusion

Businesses typically need to utilize a combination of these strategies to keep cash flow healthy. Each situation is unique, so use these deep dives to develop a customized plan for your business.

Important Note: Remember, these strategies often interconnect. For instance, buying new equipment is an investment, but if you take out a loan for it, that impacts your financing too.